Dubai often evokes images of luxury and towering skyscrapers, which leads many to wonder: Is the cost of living in Dubai really expensive? The answer depends on your lifestyle and expectations. In this comprehensive guide, we break down the living cost in Dubai per month from housing and utilities to transportation, food, and more – to help you budget and decide if Dubai’s expenses match your income. We’ll also look at how much AED you need to live in Dubai comfortably and see how Dubai compares to other major cities.

Despite its high-end reputation, Dubai offers a range of options for different budgets. Some aspects of life (like rent) can be costly, while others (like fuel and taxes) are surprisingly affordable. Living in Dubai per month can be manageable with strategic choices. Let’s dive into the details of the average cost of living in Dubai in AED and find out whether Dubai is truly expensive or if it offers value for money.

| Category | Average Monthly Cost (AED) | Notes |

|---|---|---|

| Rent (1BR Apartment) | 3,500 – 8,000 | Depends on location (Dubai Marina, Downtown vs. outskirts) |

| Utilities (Electricity, Water, Cooling) | 600 – 1,200 | Higher in summer due to AC usage |

| Internet & Mobile | 300 – 400 | Etisalat / Du packages |

| Transportation | 300 – 1,500 | Public transport pass: ~AED 300 / Car expenses much higher |

| Groceries | 1,000 – 1,800 | For a couple, mid-range lifestyle |

| Dining Out | 800 – 2,000 | Mix of budget & mid-range restaurants |

| Healthcare (Insurance Premiums) | 500 – 1,200 | Basic to comprehensive plans |

| Education (per child) | 2,000 – 5,000 | Varies by school & curriculum |

| Entertainment & Leisure | 500 – 1,500 | Gyms, movies, outings |

| Overall Living Cost | 8,000 – 20,000+ | Depends on lifestyle & family size |

Housing Costs in Dubai (Rent and Apartments)

Housing is typically the largest monthly expense for anyone living in Dubai. Rental prices vary greatly based on location, size, and type of accommodation. Here’s a quick overview of what you might expect to pay:

-

Apartment Rentals: In central areas like Downtown or Dubai Marina, a one-bedroom apartment averages around AED 8,000+ per month (approximately AED 100k–115k per year). Less centrally, for example in Jumeirah Village Circle (JVC) or Dubai Sports City, one-bedroom rents drop to roughly AED 5,000–7,000 per month. For larger units, a three-bedroom in the city center can cost AED 15,000 or more monthly, whereas outside the center it’s about AED 10,000 per month. These figures show how much apartments cost in Dubai for rent, illustrating the premium for prime locations.

-

Villa Rentals: If you need more space, villas (often 3+ bedrooms with yard) in suburban areas start around AED 10,000–15,000 per month, but can go much higher in upscale communities.

Keep in mind that annual rental contracts are the norm, often paid with a few large post-dated checks rather than monthly. Some landlords might ask for 1–4 checks (quarterly or bi-annual payments), though an increasing number allow monthly payments.

Dubai’s rent prices have been rising in recent years. In fact, rents jumped roughly 16% year-on-year in 2024 on average, with luxury apartments seeing increases of 25–30%. This surge has led many expats to negotiate higher housing allowances with employers. Despite rising costs, Dubai’s rents are still lower than cities like New York or London when you consider what you get. For instance, a one-bedroom in Dubai’s city center (~AED 8k/month) would be 30–40% cheaper than an equivalent in London, and Dubai is about 50% cheaper than New York City in overall living costs.

Buying Property: Purchasing an apartment is a big upfront cost (prices vary widely by location and property type), so most new arrivals rent initially. As a rough idea, buying a mid-range one-bedroom apartment might cost upwards of AED 1 million, but this falls outside monthly living expenses and into long-term investment.

Housing Tips: If you’re on a budget, consider more affordable neighborhoods (e.g., Al Nahda, Deira, or International City) or sharing accommodation. Living a bit farther from the city center can significantly cut costs sometimes by 30–40% less rent for similar-sized apartments. Just balance commute times and transport costs if you choose a cheaper area.

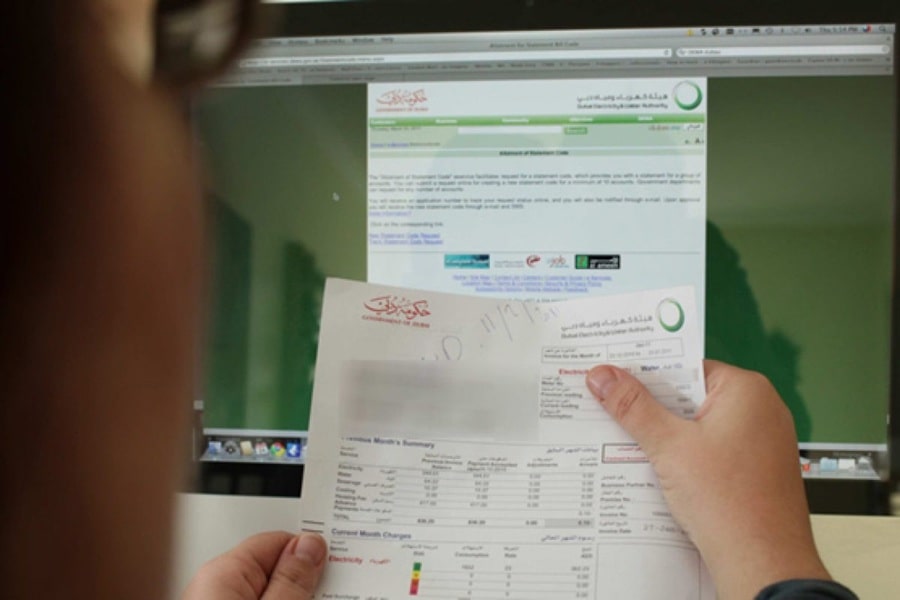

Utilities and Household Bills in Dubai

Utilities in Dubai include electricity, water, cooling (air conditioning), and internet/phone services. Given the hot climate, air conditioning is a major component of utility bills. Here’s what to expect per month for a typical apartment:

-

Electricity, Water & Cooling: Around AED 500 to AED 1,200 per month for a one-bedroom apartment. Smaller apartments or frugal energy usage might keep it near the lower end (~AED 500-600), whereas a larger 2-3 bedroom or heavy AC use in summer pushes it toward AED 1k+. Villas (being larger) will incur higher cooling costs, sometimes AED 1,500+ in summer months.

-

Internet: High-speed home internet in Dubai costs roughly AED 300 per month for a standard package. Many providers (e.g., Etisalat or Du) bundle internet with TV and landline service. You might find basic plans slightly under AED 300, but premium fiber-optic packages with TV can be AED 400-500. Mobile phone plans are separate; a mobile package with calls and data might be around AED 250 monthly, though prepaid options can be cheaper.

-

Other: If you subscribe to pay-TV packages or streaming services, factor those in. A basic gym membership is another “utility” for some lifestyles, averaging maybe AED 200–400 per month at popular gyms.

Dubai’s utility costs are moderate compared to global cities. For example, monthly utilities for an 85 m² apartment average about AED 700–800, which is lower than London where the same might be AED 1,200+. This is partly due to government subsidies and the lack of heating costs (you’ll run AC, not heaters, even in winter).

Saving on Utilities: To keep bills down, use AC wisely – many apartments have a separate chiller fee for central cooling in newer buildings, so be aware of that. Water is relatively inexpensive, but electricity usage spikes from AC. Energy-efficient appliances and thermostat control help. Some buildings include chiller (AC) charges in the rent or maintenance, so that’s a bonus to look for when renting.

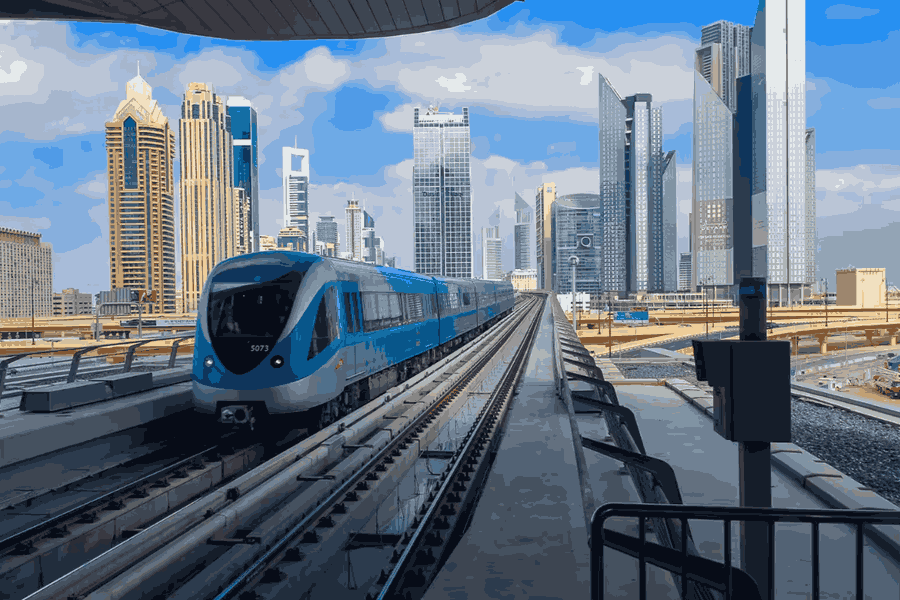

Transportation Costs in Dubai

Getting around Dubai can involve public transport, taxis, or owning a car. The good news is that fuel is cheap and public transit is affordable; the challenge is that the city is spread out, so many expats end up driving. Let’s break down transport options:

-

Public Transport: Dubai has an excellent Metro system, public buses, and trams in some areas. A typical monthly public transport pass costs around AED 300 (about AED 80 in USD terms), which allows unlimited travel in standard class across zones. If you mostly use the Metro/bus occasionally, you might spend AED 5–15 per trip with a rechargeable Nol card (Dubai’s transit card). Overall, public transport commuting could be AED 250–400 per month for a regular user. This is far cheaper than in many Western cities – for example, a monthly transit pass in London is equivalent to AED 800+, versus ~AED 300 in Dubai.

-

Taxis: Taxis are plentiful and cheaper than in many global cities. Dubai taxi fare per km is roughly AED 2.2–2.5 per kilometer, with a base fare of AED 5 during the day (AED 5.50 at night). The minimum taxi fare is AED 12. In practice, a short ride within downtown might cost ~AED 15, while a 10 km ride comes to around AED 25–30. Even a cross-city journey (e.g., 20 km) would be on the order of AED 50–60, which is reasonable by international standards. For reference, 5 km in a taxi would total about AED 16 (base fare + distance). Tip: Taxi fares adjust slightly with fuel prices, so they inched up in 2024 (from AED 1.97 to AED 2.26 per km over the year), but they’re still affordable. If you use taxis daily for work commutes, it could add up to a few hundred dirhams per month. Ride-hailing services like Uber/Careem are also available, generally at similar or slightly higher cost than regular cabs.

-

Car Ownership: Many expats choose to drive in Dubai since petrol is cheap and parking is ample in most areas (except dense districts during peak times). Owning a car entails the car loan or lease cost, fuel, insurance, and maintenance:

-

Fuel: Gasoline is inexpensive: roughly AED 3.0–3.5 per liter (around USD $0.80-$0.95) as of 2024, meaning you can fill up an average sedan for about AED 150. Unless you have a long commute, monthly fuel might be only AED 200–500.

-

Insurance: Annual insurance for a typical car can range from AED 1,500–3,000 (so about AED 125–250 monthly when averaged).

-

Car Payments: If you finance a car, a modest sedan might be AED 1,000–1,500 per month on a loan. Used cars can be bought outright for less. Alternatively, long-term leasing is popular; a new economy car lease might be ~AED 1,500–2,000 per month, whereas a luxury SUV could be AED 3,000+ monthly.

-

Maintenance & Others: Oil changes, servicing, etc., maybe AED 200–300 monthly averaged out. Also consider Salik (toll) charges if you pass toll gates (each Salik pass is AED 5). Parking fees apply in many areas (but often only a few dirhams per hour, or free in residential zones with a permit).

Adding these up, owning a car could cost around AED 2,000–3,500 per month all-in for a typical expat car (loan + fuel + insurance). If your car is paid off or you go for a cheaper model, it can be less.

-

-

Car Rental: If you don’t want to commit to buying a car, you can rent a car in Dubai short-term or monthly. Rental rates start at roughly AED 80–100 per day for an economy car. Monthly discounts are common monthly car rentals can be found for around AED 1,400–2,000 for economy models, while higher-end cars will cost more (luxury models might be AED 3,000+ per month). Renting can be convenient and often includes maintenance and insurance. Many newcomers rent initially to get around, or long-term residents might rent to avoid loans. Just remember to budget for fuel and Salik on top.

-

Driving License: If you plan to drive, you’ll need a UAE driving license. Tourists and short-term visitors can drive with an international driving license in the UAE (alongside your home country license), but residents must obtain a local license. Converting your license or taking driving tests can cost a few thousand dirhams in fees if you go through training. An International Driving License UAE issuance itself costs about AED 170–200, which is useful for visitors. But once you have a residency visa, you should get the UAE license. Keep in mind the costs of driving school if needed (can be ~AED 5k).

Bottom line: If you rely on public transport and taxis, you might spend only a few hundred dirhams each month (e.g., ~AED 300–500). Owning or renting a car is more convenient but pushes transport costs to a few thousand dirhams monthly. Many expats do a cost-benefit analysis of buying a car vs using taxis, depending on their commute distance and lifestyle. Notably, Dubai’s taxi fare per km and cheap fuel make occasional taxi rides or Uber often cheaper than owning a second car.

Food and Grocery Expenses in Duabi

Food costs in Dubai can range from very affordable (if cooking at home and buying local products) to sky-high (if you dine at five-star restaurants regularly). Let’s break down daily living food expenses:

-

Groceries: If you cook most of your meals, a single person’s grocery bill might be around AED 800–1,200 per month. This covers a mix of staples, some meats, produce, etc. Families (four people) typically spend AED 3,000–4,000 per month on groceries. Shopping at hypermarkets like Carrefour, Lulu, or Union Coop offers competitive prices. Here are some typical grocery prices:

-

Milk (1 liter): ~AED 7

-

Bread (loaf): ~AED 5

-

Eggs (dozen): ~AED 10

-

Chicken breast (1 kg): ~AED 20-25

-

Rice (5 kg): ~AED 40-50

-

Apples (1 kg): ~AED 8-10

These are general estimates; buying local or store brands can be cheaper, while imported organic goods cost more. Overall, grocery costs in Dubai are comparable to Western countries and sometimes lower for fruits, vegetables, and poultry. Many items (especially imports) are priced similarly or slightly higher than in Europe or the US. You can save by buying from wholesale markets (e.g., the Deira fish market or Al Awir fruit & veg market) for bulk produce, or choosing supermarket promotions.

-

-

Dining Out: Dubai has a vast range of eateries – from street shawarma joints to ultra-luxury dining. An inexpensive meal at a local café or casual restaurant costs about AED 30–50 (e.g., a biryani or a shawarma with a drink). A McDonald’s combo meal is around AED 30. For mid-range dining, a three-course dinner for two at a decent restaurant might be AED 250–350 total. For example, two people at a mid-range restaurant could spend ~AED 300 (about $80). High-end restaurants (like those run by celebrity chefs or in 5-star hotels) can charge AED 500+ per person for a lavish dinner. Alcohol will significantly increase your bill – a beer in a pub costs around AED 40-50 (about $12), and a glass of wine might be AED 40–60 at a restaurant. Keep in mind, Dubai adds municipality tax and service charge at restaurants (typically 10% each, plus 5% VAT).

-

Monthly Food Budget: Combining groceries and some dining out, an individual might spend AED 1,000–1,500 per month total on food if being moderate (mostly cooking, plus a few outings). If you dine out frequently or have a family, this could rise to AED 2,000–3,000+ monthly on food and dining. Pacific Prime’s expat guide noted ~USD $455 (AED ~1,670) per month for an individual’s food expenses on average, and about $1,178 (AED ~4,300) for a family of four, which aligns with our estimates.

Money-Saving Tips: To keep food costs down, eat like the locals. There are many affordable eateries serving Indian, Pakistani, Filipino, or Arabic cuisine where you can get a filling meal for under AED 30. Grocery shopping at co-ops or Carrefour during sales, and buying local produce (or brands) instead of imported ones, also cuts costs. On the flip side, be prepared to pay more for specialty diets (gluten-free, vegan specialty products, organic, etc. are available but pricy).

Entertainment and Leisure in Dubai

Life isn’t just about necessities enjoying Dubai is part of the experience! Entertainment costs will depend on your interests, but here are common expenses to consider:

-

Attractions: Many of the best things to do in Dubai are actually free or reasonably priced. Strolling through Dubai Mall or along the Marina costs nothing, and so doesn’t watching the spectacular Dubai Fountain show. Public beaches (e.g., JBR Beach, Kite Beach) are free to access, you might just spend on food or rentals there. Visiting the historic Al Fahidi district or the souks in Deira is very low cost (a few dirhams for an abra boat ride across the creek). However, paid attractions can add up: visiting the Burj Khalifa observation deck is around AED 150–200 per adult (depending on level and time). A desert safari with dinner might be AED 150–300 per person. Theme parks (IMG World, Motiongate, etc.) are roughly AED 250 per ticket. Ski Dubai (indoor ski slope) is about AED 200–300 for a session including gear. Plan wisely which attractions matter to you.

-

Going Out: A night at the movies costs about AED 45 per ticket. Popcorn combo might add another AED 30. A pint of beer at a bar is ~AED 40-50 as mentioned (alcohol is pricey due to taxes). Brunch (a popular Dubai weekend activity) can range from AED 150 (soft drinks only) to AED 400+ (with alcohol) per person. Clubs often have high drink prices and sometimes entry fees. If you enjoy nightlife, budget accordingly (or take advantage of ladies’ nights and happy hours for deals).

-

Activities: Gym memberships average AED 200-300 per month for good facilities (some upscale ones are more). If you prefer outdoor exercise, many parks (like Safa Park, Zabeel Park) have a nominal entry fee of AED 5 or are free, and you can jog or picnic. There are also free community events, especially during the cooler months, such as outdoor movie nights, festivals, and markets.

-

Kids’ Entertainment: If you have children, you might visit indoor play areas (often AED 50-100 entry), water parks (AED 200+ tickets), or family attractions like Dubai Aquarium (AED 100+). These can add a lot to the family entertainment budget if done frequently.

-

Monthly Leisure Budget: It truly varies, but an individual might spend AED 500–1,500 per month on recreation (the lower end if mostly sticking to free activities and the occasional outing, the higher end if regularly dining out or paying for attractions). A couple could spend AED 1,000–3,000; a family could easily spend AED 2,000+ if doing outings on weekends. These ranges from the Betterhomes guide give a sense: for a single entertainment ~AED 650–1,500; for a couple AED 1,200–3,000; for a family perhaps AED 2,000–3,000.

The great thing is you don’t have to spend a fortune to enjoy Dubai. Many of Dubai’s highlights – the beaches, the winter weather for outdoor gatherings, walking around vibrant neighborhoods – cost little to nothing. Of course, if your idea of fun is shopping in high-end boutiques or fine dining every week, then your cost of living will reflect that.

Healthcare cost in Dubai

Healthcare: Dubai offers high-quality healthcare, but it comes at a price. By law, employers must provide health insurance to employees (and often their dependents), which covers basic medical care. If you want more comprehensive coverage or if you’re self-employed, you’ll need to purchase private insurance. Basic individual health insurance might cost AED 3,000–5,000 per year, whereas a premium family plan can be AED 10,000+ per yea. If you have employer coverage, most day-to-day costs will be co-pays. Without insurance, a routine doctor visit is around AED 200–500 for a general practitioner. Specialists can be AED 300–700 per visit. Prescription medications vary, but many common meds are priced similarly to Europe/US. Emergency care and hospitalization are expensive without insurance, so do not skip health insurance, it’s mandatory for residence visas anyway. The upside: there’s no general income tax, but note that there is a 5% VAT on most goods and services, including private medical bills.

Education Costs in Dubai

Education: If you’re moving with kids, schooling will be a significant cost. Public schools in UAE (Arabic curriculum) are generally only for locals, so expat children typically attend private schools. Annual fees for private schools range widely from about AED 20,000 up to AED 60,000+ per child, depending on the school’s curriculum and reputation. For example, a mid-tier British curriculum school might charge ~AED 30,000 per year for primary grades, whereas a top-tier international school can be AED 50k or more. Nursery or preschool for younger kids is also costly – perhaps AED 15,000–40,000 per year. And these are just tuition fees; you’ll also pay for uniforms, books, bus transport, and extracurriculars. It’s not unusual for a family to budget AED 100k+ per year per child for education at the high end. On the bright side, there are many choices, and some employers offer schooling allowances.

Miscellaneous in Dubai

Taxes: Worth noting – Dubai (and the UAE) has no personal income tax. This is a huge financial advantage. A salary in Dubai is tax-free, meaning a higher net income compared to a similar gross salary in a country with income tax. This often offsets the high living costs. Many expats find that while they spend more on rent or schooling, not paying 20-40% income tax (as they would back home) leaves them with savings. The UAE introduced a 5% VAT on goods and services in 2018, but that’s relatively low compared to VAT/GST in Europe, for example.

Personal Spending and Miscellaneous: Don’t forget to budget for clothes, personal care, and other daily needs. Shopping in Dubai ranges from cheap bargains in souks to luxury brands in malls. Basic clothing from fast fashion retailers costs roughly the same as in other countries. Personal care (haircuts, salon, etc.) also varies: a men’s haircut might be AED 50 at a local barbershop or AED 150 at a high-end salon; ladies’ salon visits obviously more. Many people also pay for home services like cleaning – a part-time maid service could cost ~AED 30–40 per hour, and some hire full-time live-in help (with salaries around AED 2,000 monthly, plus visa and accommodation costs).

How Much Money Do You Need to Live in Dubai?

After examining all these expenses, how much AED per month do you need to live in Dubai comfortably? The answer depends on your family size and lifestyle, but we can give some ballpark figures:

-

Single Expat: You can survive on a modest salary of around AED 7,000–9,000 per month if you live in shared housing, cook at home, and use public transport – but that would be a tight budget. To live comfortably (rent your own small apartment, go out occasionally, and save a bit), a salary of AED 10,000 to AED 15,000 per month is often quoted as suitable. Many sources recommend around AED 15,000+ for a single person to have a comfortable lifestyle with some disposable income. This would cover a decent one-bedroom rent, utilities, food, transport, and some entertainment. If you want a more upscale lifestyle (bigger apartment or frequent fine dining), then AED 20,000+ would give you more leeway.

-

Couple: For a couple without kids, consider that you’d likely want a 1 or 2-bedroom apartment and you’ll have higher food and going-out costs than a single person (but you can share some expenses). A combined income of around AED 15,000 to AED 25,000 monthly is usually enough for a comfortable life as a couple. On ~15k you may need to budget carefully; with ~20–25k you can afford a nicer flat or save more. Job relocation guides often suggest ~AED 20k for a couple to live well.

-

Family of Four: With kids, the major extra costs are larger housing (likely 2-3 bedroom apartment or villa) and school fees. A family of four might spend AED 20,000 just on basic monthly expenses (rent, bills, groceries) even before school or childcare. To live comfortably and cover a couple of kids’ schooling, many estimate AED 30,000 or more per month is needed. In fact, an upper-middle lifestyle for a family (nice 3-bedroom, two kids in good schools, one car, etc.) could require AED 35,000–40,000 monthly to also have savings. Some breakdowns show a family of four’s living cost (excluding rent) around AED 14,000, and when you add rent and school, it easily doubles. So if your family earns, say, AED 40k/month combined, you can live very comfortably. At AED 20k for a family, you’d have to be quite frugal (maybe live in a cheaper area, use public schools if eligible, etc.).

To put it in perspective: Dubai is ranked the most expensive city in the Middle East, and within the top 20 globally, according to Mercer’s cost of living index. Yet, thanks to zero income tax, a salary in Dubai can go further than in other expensive cities. One analysis showed Dubai’s living expenses (with no tax) can be ~36% cheaper than London’s when factoring in taxes and prices. Similarly, Dubai is around 45% less expensive than New York City in overall cost of living (excluding rent), and about 33% cheaper than London in basic expenses. So while Dubai is expensive, it’s not necessarily more expensive than other major expat hubs once you adjust for earnings and tax.

Average cost of living in Dubai in AED: According to multiple sources, an average single person’s monthly expenses (excluding rent) are about AED 4,000–4,500. Add average rent (say AED 5,000 for a modest apartment), and you get roughly AED 9,000 per month for an average single. For a family of four, non-housing expenses might be AED 12,000–15,000 per month, and housing (a 3-bedroom) around AED 10k, totaling roughly AED 22,000–25,000 per month. Of course, many families spend more due to schooling. These are just averages – your mileage may vary depending on lifestyle.

Is Dubai Really Expensive? Final Thoughts

Dubai’s cost of living definitely isn’t cheap, but it offers value and a spectrum of choices. You can dine at a $5 shawarma stand or a $300 Michelin-star restaurant; live in a modest flat or a luxury villa on the Palm. The city caters to both budget-conscious residents and those seeking extravagance.

By global standards, Dubai sits in the higher tier of living costs (often cited among the top 15-20 priciest cities worldwide). Key expenses like rent and schooling can be very expensive. However, some factors counterbalance this:

-

No income tax on your salary (which is a huge saving compared to high-tax countries).

-

Cheaper transportation (fuel and public transit) than many major cities.

-

Competitive grocery prices for many items, and affordable utilities by global standards.

-

High salaries in many industries (especially for expats in professional jobs) help meet the costs, and many expats get housing, transport, or education allowances as part of their packages.

In day-to-day life, many residents feel Dubai is manageable with proper budgeting. You might pay a lot in rent, but save on cars or groceries. Or you might splurge on entertainment but live in a cheaper area. As Gulf News noted, while some costs (like housing or schools) are high, overall Dubai can be ~38% cheaper than London when you factor everything in, and careful budgeting makes it feasible.

Ultimately, calling Dubai “really expensive” is relative. It ranks as expensive in the world, yet it’s more affordable than places like New York, London, Hong Kong or Zurich when comparing similar lifestyle baskets. If you earn a decent, tax-free income, you can enjoy a high standard of living in Dubai. However, those in lower-paying jobs might struggle with the high rents.

Conclusion: For a comfortable life, aim for a salary that meets the guidelines we discussed (e.g., 10-15k AED for singles, 25k+ for families). With that, you can cover the living cost in Dubai per month and have some fun as well. Dubai can be as expensive as you make it – you have the choice to live modestly or extravagantly. The city’s quality of life , modern infrastructure, low crime, sunny climate, and endless things to do – often justifies the price tag for those who move here. So, if you budget wisely, Dubai doesn’t have to break the bank, and you may find that its expensive reputation is balanced out by tax savings and the unique opportunities the city offers.

FAQs

How much is the living cost in Dubai per month for a single person?

A single person in Dubai spends around AED 4,000–5,000 per month on basic expenses excluding rent. With rent included, that could be roughly AED 8,000–10,000 per month for a modest lifestyle. To live more comfortably (nicer apartment, some dining out), you might need about AED 12,000–15,000 per month in total.

Q: What is the average cost of living in Dubai in AED for a family?

A: For a family of four, basic monthly expenses (food, transport, utilities) can be around AED 12,000–15,000, and housing (rent) could add another AED 10,000–15,000 depending on size and location. So, a total of AED 22,000–30,000 per month is a typical range. If children are in private school, add schooling fees on top (which can be several thousand dirhams per month when averaged over the year).

How much AED do you need to live in Dubai comfortably?

For a single person, about AED 10k–15k per month is generally considered comfortable. For a couple, around AED 15k–25k combined. For a family, roughly AED 25k–40k or more, depending on kids’ education costs. These figures assume you want a bit of disposable income and aren’t living paycheck to paycheck. People certainly live on less, but they might have to compromise on housing or savings.

Are cars and transport expensive in Dubai?

Transport is one area where Dubai is not too expensive. Petrol is cheap (around AED 3/liter), and public transportation is a bargain (monthly metro pass ~AED 300). Owning a car involves costs like insurance and maintenance, but no annual car tax. A modest car might cost you AED 2k/month all-in. Taxis are also affordable – the Dubai taxi fare per km is only about AED 2.2, so a short ride may cost AED 20 or so. Many expats find transportation costs reasonable, especially compared to cities with costly transit or petrol.

Is it expensive to rent a car in Dubai instead of buying one?

Renting a car can be quite feasible. You can rent a car in Dubai for around AED 1,400–1,800 per month for an economy model on a long-term (monthly) rate. That often includes maintenance and basic insurance. Daily rentals for visitors start around AED 80-100 per day for small cars. So, if you’re staying short-term or don’t want the commitment of owning, renting is a good option. It’s more expensive long-term than owning a cheap used car, but for convenience and short stays, many prefer renting.

What about other living costs, like healthcare and bills?

Utilities can range from AED 600 to 1,200 per month for an apartment (higher if you have a big place). Internet is ~AED 300/month. Healthcare is often covered by insurance – if you have a good employer plan, you’ll pay little out of pocket. If not, you should buy insurance; basic plans might be ~AED 4k/year. Without insurance, doctor visits typically cost a few hundred dirhams each. Fortunately, there’s no income tax, which helps balance these costs.

How does Dubai’s cost of living compare internationally?

Dubai is among the pricier cities worldwide, ranked 15th most expensive globally in one 2024 survey. But it’s cheaper than cities like London, New York, or Singapore in many respects. For example, Dubai was ~36% cheaper than London as of 2025 data when considering rent, transport, etc., plus Dubai has zero income tax. Compared to New York, Dubai can be nearly half the cost in overall expenses. Regionally, Dubai is the costliest city in the Middle East. In short: expensive, but often still a better value-for-money proposition for expats when you factor in the whole picture.

Can I save money while living in Dubai or will I spend it all on living costs?

You can absolutely save, especially if you earn a strong salary. Many expats manage to save a portion of their income thanks to the lack of income tax. The key is living within your means – for instance, choosing a reasonably priced apartment and not overspending on luxury. There are many ways to be frugal in Dubai (e.g. using the metro, shopping during sales, enjoying free activities). If you budget wisely, you can enjoy a good lifestyle and still put money aside. In fact, the absence of income tax itself boosts saving potential for most peoplegulfnews.comgulfnews.com.